GBP/JPY Price Analysis: Bounces off weekly lows, though stalls at 163.00

- GBP/JPY recovered Tuesday’s losses, gaining in the week, so far 1.05%.

- Short term, the GBP/JPY is upward biased, though facing solid resistance at the 100-day EMA around 163.00.

The GBP/JPY slightly advances as the Asian session begins, following a positive trading session for the British pound, which recovered Tuesday’s losses, courtesy of BoE’s Governor Andrew Bailey, who spooked investors when he said that the BoE due date for the emergency buying program, would be October 14. Traders reacted negatively, dumping risk-perceived assets. At the time of writing, the GBP/JPY is trading at 162.90.

On Wednesday, the GBP/JPY opened below the 160.00 mark, rallying sharply close to 300 pips. Why? All this happened as market sentiment improved earlier in the New York session and relieved that the UK’s Chancellor of the Exchequer, Kwarteng, authorized an additional 100 billion quid for the BoE, increasing its bond purchasing power to GBP 995 billion.

GBP/JPY Price Forecast

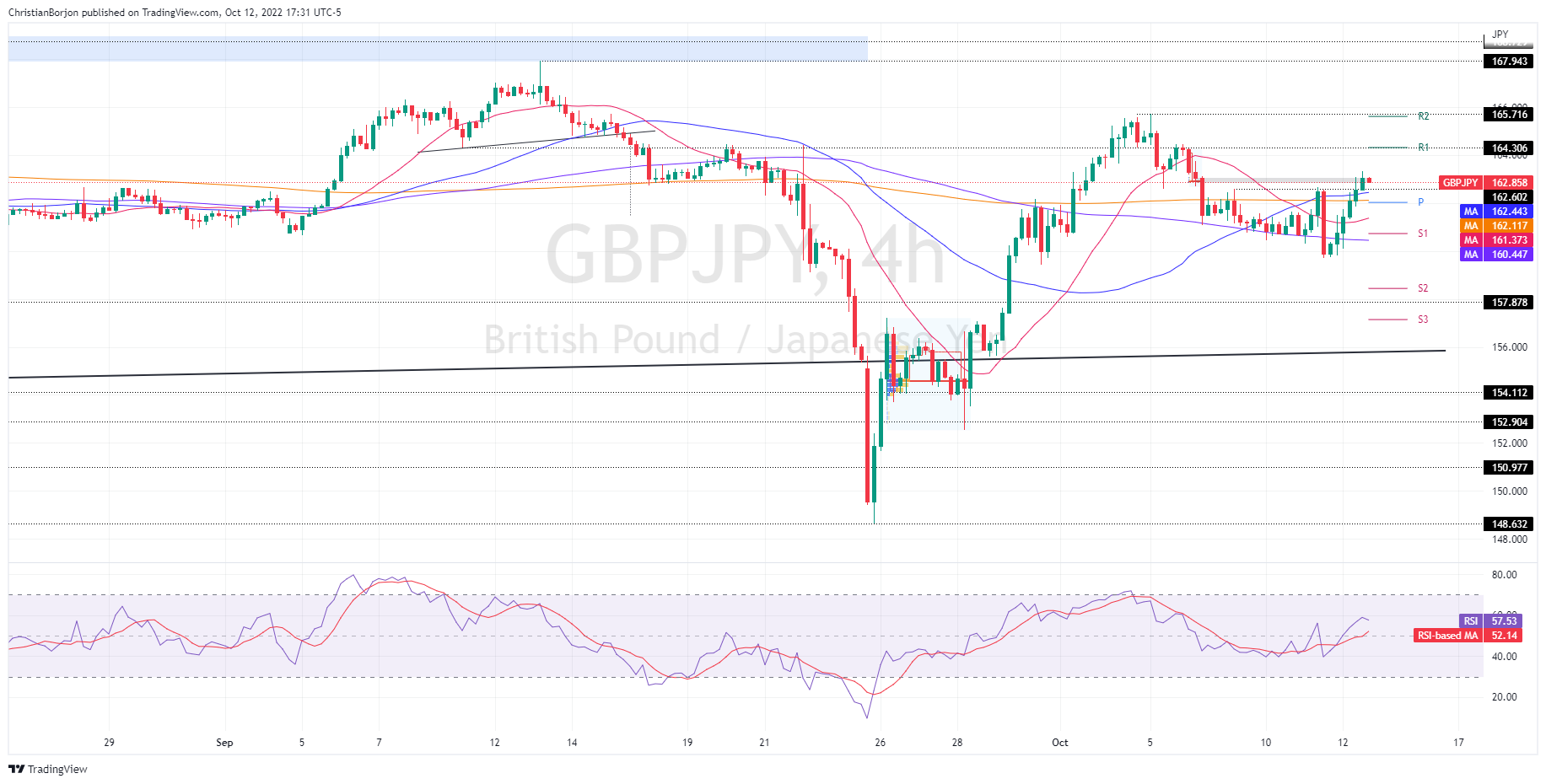

Given the backdrop, the GBP/JPY is still neutral-to-upward biased. Even though the GBP/JPY faces solid resistance around the 100-day EMA at 163.13, the GBP/JPY registered a fresh four-day high, meaning buyers are gathering momentum. Another factor that justifies the bias is the RSI on bullish territory, which could exacerbate a rally towards October 5 cycle high at 165.71.

The GBP/JPY four-hour scale illustrates six-consecutive bullish candles as the cross-currency pair edged toward 163.00. On its way upwards, the pair cleared the 20, 50, and 200-EMA, opening the door for further gains. Key resistance lies at the R1 daily pivot found at 164.30, which is also October’s 5 cycle high. Break above will expose the 165.00 figure, followed by the confluence of the October 4 daily high and the R2 pivot point at 165.71.

GBP/JPY Key Technical Levels