Silver Price Analysis: XAG/USD consolidates around 200-hour SMA, just above mid-$23.00s

- Silver stalls the overnight recovery move near the $23.70-80 support breakpoint.

- The technical setup warrants some caution before placing fresh directional bets.

- A break below the $23.00 mark is needed to support prospects for deeper losses.

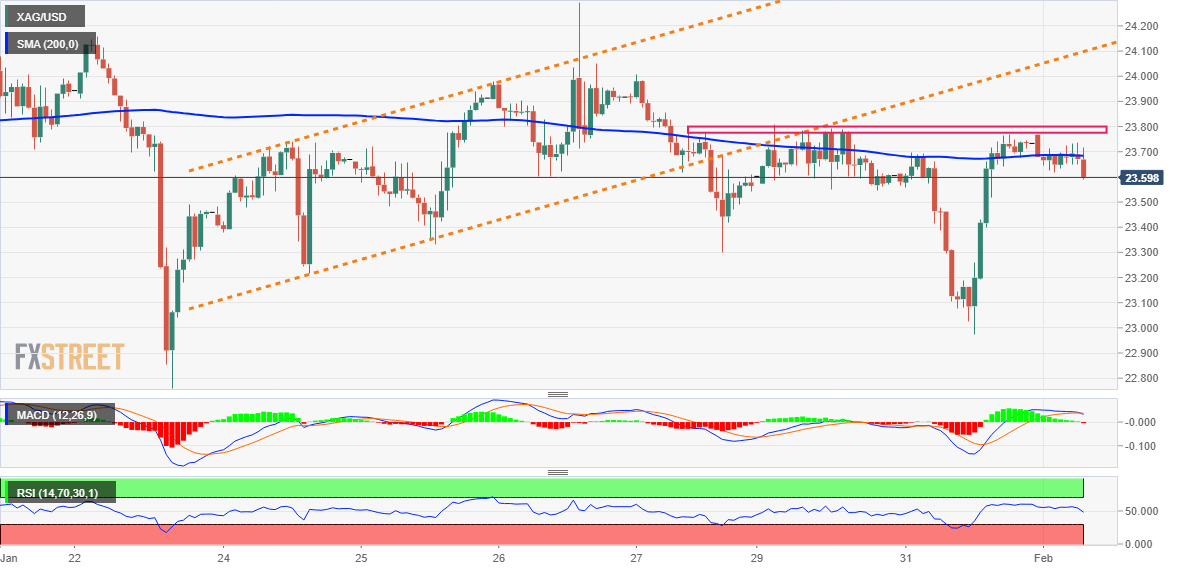

Silver struggles to capitalize on the previous day's goodish rebound from sub-$23.00 levels, or over a one-week low and oscillates in a narrow band through the early European session on Wednesday. The white metal is currently placed just above the mid-$23.00s, consolidating around the 200-hour SMA.

From a technical perspective, the XAG/USD remains capped near the $23.70-$23.80 support breakpoint, marking the lower end of a short-term ascending trend channel. The said area might act as a pivotal point for traders, which if cleared decisively should pave the way for some meaningful upside.

The XAG/USD might then aim to surpass the $24.00 round figure and retest the multi-month top, around the $24.50-$24.55 zone touched in January. The positive momentum could get extended further and allow bullish traders to reclaim the $25.00 psychological mark for the first time since April 2022.

That said, neutral technical indicators on daily/4-hour charts warrant some caution before positioning for a further near-term appreciating move. Moreover, the recent rangebound price action witnessed since December 21 points to indecision among traders over the next leg of a directional move for the XAG/USD.

In the meantime, the $23.30 area might now protect the immediate downside ahead of the overnight low, around the $23.00-$22.95 region. This is closely followed by support near the $22.75 region, which if broken decisively will make the XAG/USD vulnerable to fall towards the $22.20-$22.15 support.

Silver 1-hour chart

Key levels to watch