Back

29 Jun 2023

Crude Oil Futures: Near-term correction in the offing?

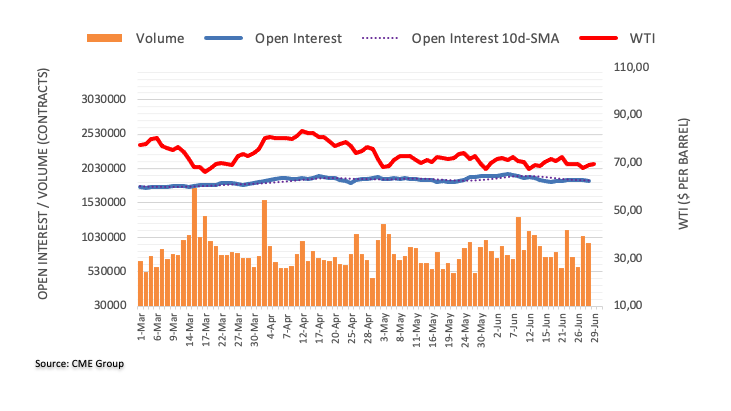

CME Group’s flash data for crude oil futures markets noted traders trimmed their open interest positions for the second session in a row on Wednesday, this time by around 11.4K contracts. In the same direction, volume went down by around 109.1K contracts, partially reversing the sharp build seen in the previous session.

WTI appears capped by $70.00

Wednesday’s rebound from the vicinity of the $67.00 region came along diminishing open interest and volume, suggesting that a meaningful move higher in WTI appears out of favour in the very near term at least. In the meantime, the $70.00 region per barrel seems to be quite a decent resistance zone.