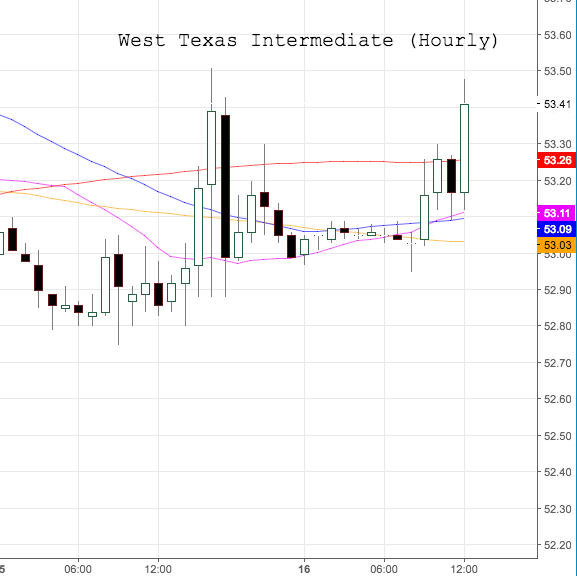

WTI leaps to daily highs near $53.40

Crude oil prices are trading on a firm note on Thursday, lifting the West Texas Intermediate to the area of session peaks around $53.40 per barrel.

WTI up on weaker USD, OPEC headlines

Prices for the barrel of the American benchmark for the sweet light crude oil met extra buying pressure today after news agency Reuters hinted at the likeliness that the OPEC/non-OPEC deal to limit crude output could be extended at the May meeting.

Adding to the upside, the greenback has surrendered part of recent gains despite the better-than-expected inflation figures and retail sales in the US economy during January and the hawkish tone from Yellen’s testimonies and further comments by FOMC governors.

WTI has managed to leave behind the recent large increase in US crude oil supplies, as reported by the API and the EIA, maintaining the sideline theme and with OPEC headlines as the almost exclusive catalyst for prices.

Later in the session, US Housing Starts, Building Permits and the Philly Fed manufacturing index should keep the attention on the buck, while driller Baker Hughes will report on the US oil-rig count on Friday.

WTI levels to consider

At the moment the barrel of WTI is up 0.53% at $53.39 facing the next hurdle at $53.90 (high Feb.13) followed by $54.13 (high Feb.10) and finally $54.34 (high Feb.2). On the flip side, a breach of $52.73 (low Feb.15) would aim for $52.63 (55-day sma) and then $51.22 (low Feb.8).