WTI retreats from yearly highs beyond $54.00

- Prices of WTI inch higher and surpass the $54.00 mark.

- OPEC+ cuts sustaining the bullish sentiment.

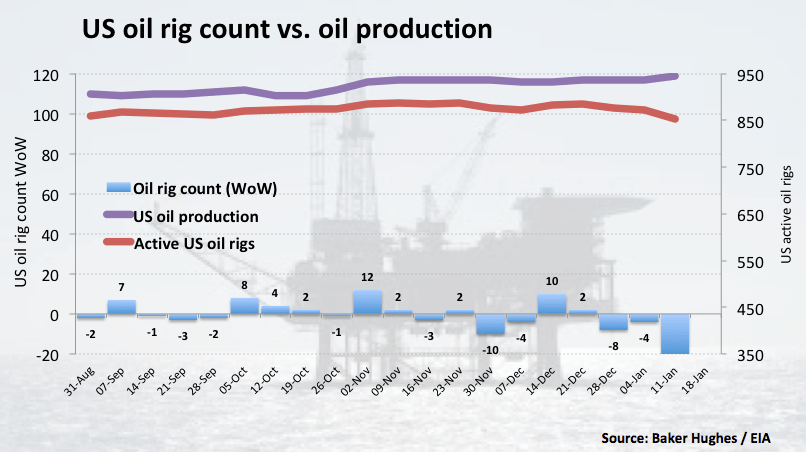

- US oil rig count down by 21 rigs during last week.

Prices of the barrel of the West Texas Intermediate have started the week on a positive fashion, advancing to fresh YTD peaks beyond the $54.00 mark albeit losing some impetus afterwards.

WTI upside bolstered by China data

Prices of the WTI area inching higher on Monday in response to rising optimism following recent Chinese data releases.

In fact, the Chinese economy expanded at an annualized 6.4% during the fourth quarter 2018, while Industrial Production expanded 5.7% from a year earlier in December and Retail Sales grew 8.2% YoY.

In addition, recent data also noted a higher oil demand in China, which is somewhat offsetting the slowdown in the economy, all rendering in a better mood around traders.

Furthermore, OPEC+ planned cuts continue to support the upside momentum in prices while a sharp drop in US oil rig count (21) during last week is also adding to the broad-based optimism.

WTI significant levels

At the moment the barrel of WTI is losing 0.03% at $53.67 facing the next support at $52.11 (55-day SMA) seconded by $50.34 (low Jan.14) and then $48.85 (21-day SMA). On the flip side, a breakout of $54.11 (2019 high Jan.21) would aim for $54.48 (monthly high Dec.4) and finally $58.00 (high Nov.18 2018).