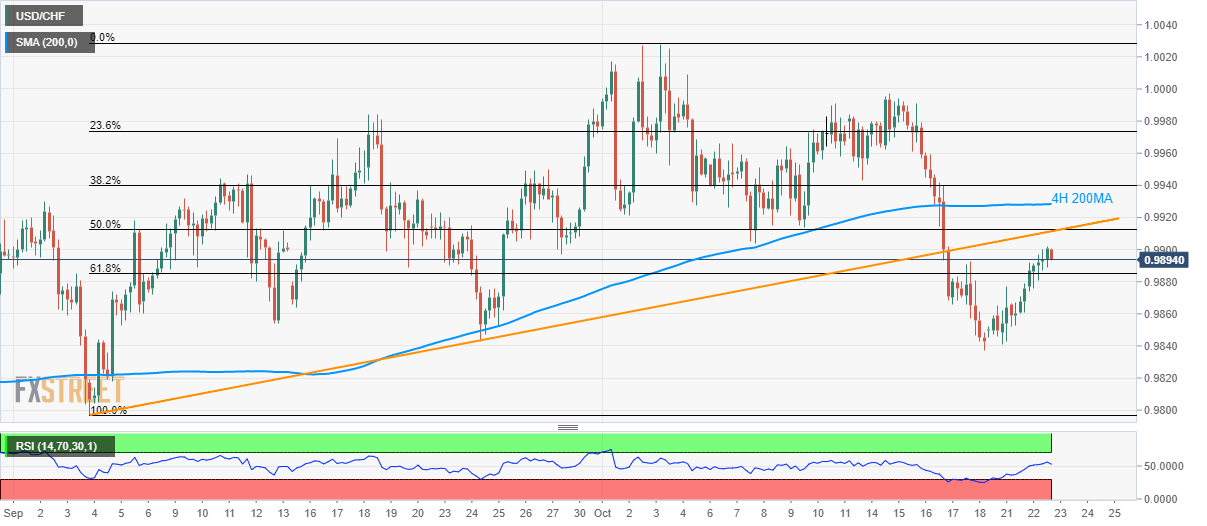

USD/CHF technical analysis: 0.9912/15, 4H 200MA limit immediate upside

- USD/CHF struggles to hold the latest recovery gains.

- A seven-week-old rising trend line, 50% Fibonacci retracement acts as the closest upside barrier.

- 61.8% of Fibonacci retracement offers adjacent support.

The USD/CHF pair’s recovery from 0.9840 seems to lack momentum as the quote witnesses a pullback to 0.9900 ahead of the European session opening on Wednesday.

With this, the 61.8% Fibonacci retracement level of September-October rise, at 0.9885, acts as the close support to watch as a break of which can recall 0.9840 on the chart.

Assuming the price decline below 0.9840, September month bottom close to 0.9800 will be on the sellers’ watch-list.

On the upside, a seven-week-old rising trend line, 50% Fibonacci retracement acts as an adjacent resistance, near 0.9912/15, ahead of 200-bar simple moving average on the four-hour chart (4H 200MA), at 0.9930 now.

It should, however, be noted that the pair’s rise past-0.9930 enables it to aim for 1.0000 round-figure and then rush to the monthly top surrounding 1.0015/20.

USD/CHF 4-hour chart

Trend: bearish