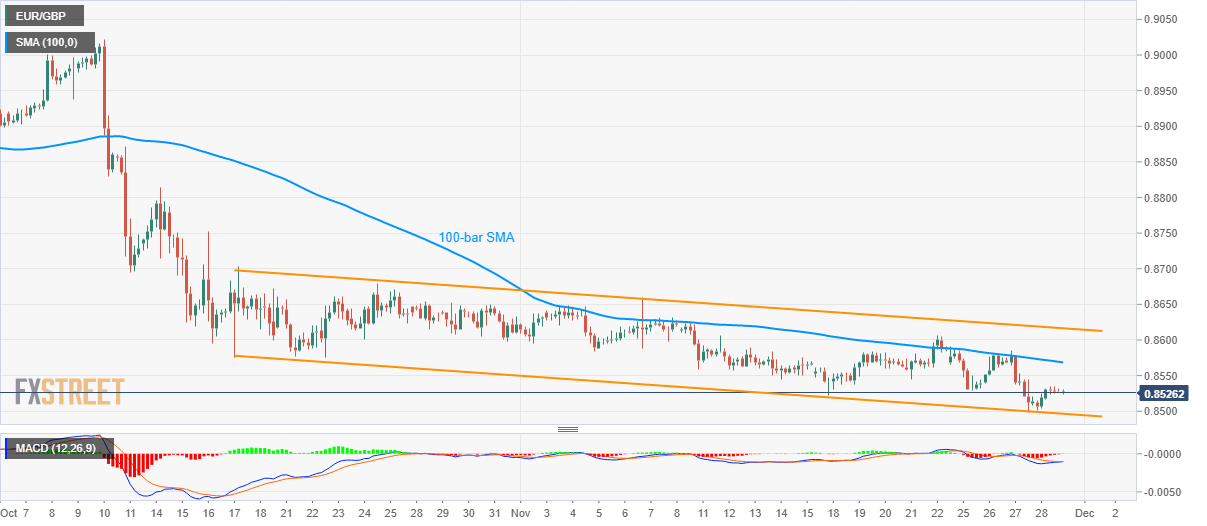

EUR/GBP Technical Analysis: Follows six-week-old falling channel ahead of German/EU data

- EUR/GBP keeps it under the near-term falling trend channel.

- 100-SMA restricts intermediate pullbacks.

- March month low offers additional support.

EUR/GBP seesaws around 0.8530 while heading into the European session on Friday.

The pair recently bounced off the seven-week-old channel’s support but fails to stay strong enough to confront the 100-bar Simple Moving Average (SMA) that limits the quote’s intermediate bounces off-late.

As a result, prices are likely to revisit the channel support level of 0.8495, a break of which could drag it to March month low of 0.8470.

Meanwhile, an upside clearance of 0.8570 mark, comprising 100-bar SMA, will trigger fresh run-up to channel’s resistance, close to 0.8620 now. If at all prices manage to remain strong beyond 0.8620, bulls can target monthly high surrounding 0.8660 ahead of looking at the 0.8700 mark.

On the economic front, German Retail Sales and Unemployment joins the Eurozone inflation data. While forecasts indicate mixed signals, TD Securities anticipate a bit higher inflation number while saying, “we look for Eurozone inflation to edge a bit higher in November, coming in at 0.8% y/y (mkt 0.9%). Underlying this, we look for core CPI to hold steady at 1.1% y/y (mkt 1.2%), but with a slightly larger rise in food prices and slightly smaller drag from energy prices to push headline CPI a notch higher.”

EUR/GBP 4-hour chart

Trend: Sideways