Back

17 Feb 2020

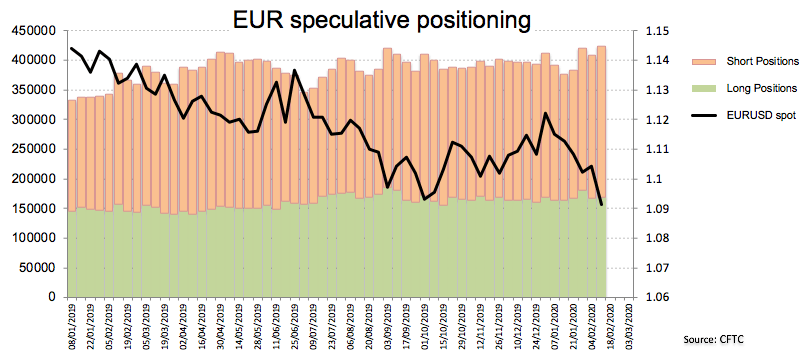

CFTC Positioning Report: EUR net shorts in multi-month highs

These are the main highlights of the CFTC Positioning Report for the week ended on February 11th.

- Speculators kept the negative view on EUR for yet another week, taking gross shorts to the highest level since early November 2016 to more than 255K contracts and therefore the net shorts climbed to the highest level since mid-June 2019. Poor results in fundamentals in the euro area reminded investors that the slowdown in the region (and the ‘looser for longer’ stance in the ECB) are here to stay.

- USD net longs climbed to the highest level since December 10th 2019 on the back of renewed inflows into the buck in response to concerns around the COVID-19. In addition, positive results from the US calendar also collaborated with the upside momentum in DXY, particularly in sharp contrast with publications in the euro area.

- Net longs in the sterling posted a 3-week high, as investors’ sentiment remains buoyant following the UK-EU divorce and ahead of key negotiations between both parties on the trade front.