EUR/USD stays firm and advances to 1.0940, US data in sight

- EUR/USD extends the recovery to 1.0940 on Thursday.

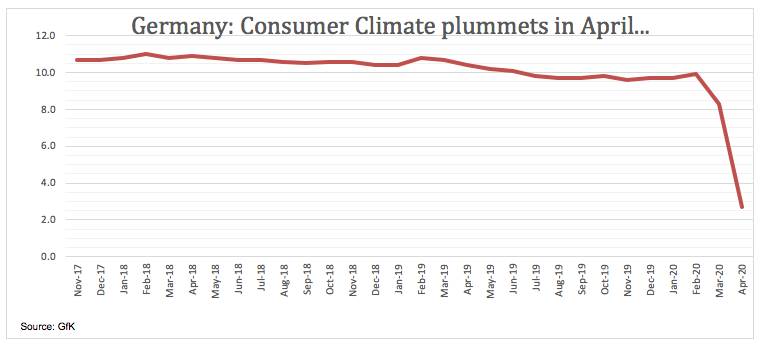

- German Consumer Climate deteriorated markedly in April.

- US Q4 GDP, Trade Balance, Claims next on the calendar.

EUR/USD is extending the weekly recovery to levels well above the 1.0900 mark in the second half of the week.

EUR/USD remains bid on USD-weakness

EUR/USD is prolonging the upside momentum for the fifth consecutive session on Thursday, always against the backdrop of the persistent selling pressure around the greenback. On the latter, it is worth mentioning that the US Dollar Index (DXY) is already shedding around 2.5% from recent tops near the 103.00 mark to the current 100.40 region.

The pair has regained momentum after the US Senate approved (96-0) a historic 42 trillion aid package to fight the fallout of the coronavirus in the US economy. The bill is now moving to the House of Representative to be voted on Friday. This stimulus package adds to Monday’s extra stimulus delivered by the Federal Reserve in the form of open-ended purchases of Treasuries and MBS, among other measures.

Data wise in Euroland, the German Consumer Climate tracked by GfK deteriorated sharply for the month pf April, falling to 2.7 from March’s 8.3 (revised from 9.8).

Still in the docket and later in the NA session, all the attention will be on the weekly release of Initial Claims, relegating advanced Trade Balance results and another estimate of the Q4 GDP to a secondary role.

What to look for around EUR

EUR/USD keeps the ‘recovery-mode’ well in place in the second half of the week, always following USD-dynamics, developments from the coronavirus and the response from overseas central banks and governments. On the latter, the Fed’s latest round of stimulus plus the US $2 trillion coronavirus aid package have been collaborating further with the rebound in the pair via a weaker dollar. On the macro view, better-than-forecasted PMIs in both Germany and the broader Euroland opened the door to some respite in the prevailing downtrend in fundamentals in the region, although the underlying stance still remains well on the negative side.

EUR/USD levels to watch

At the moment, the pair is gaining 0.52% at 1.0940 and a breakout of 1.0992 (monthly low Jan.29) would target 1.1008 (55-day SMA) en route to 1.1082 (200-day SMA). On the downside, the next support lines up at 1.0814 (78.6% Fibo of the 2017-2018 rally) followed by 1.0635 (2020 low Mar.23) and finally 1.0569 (monthly low Apr.10 2017).