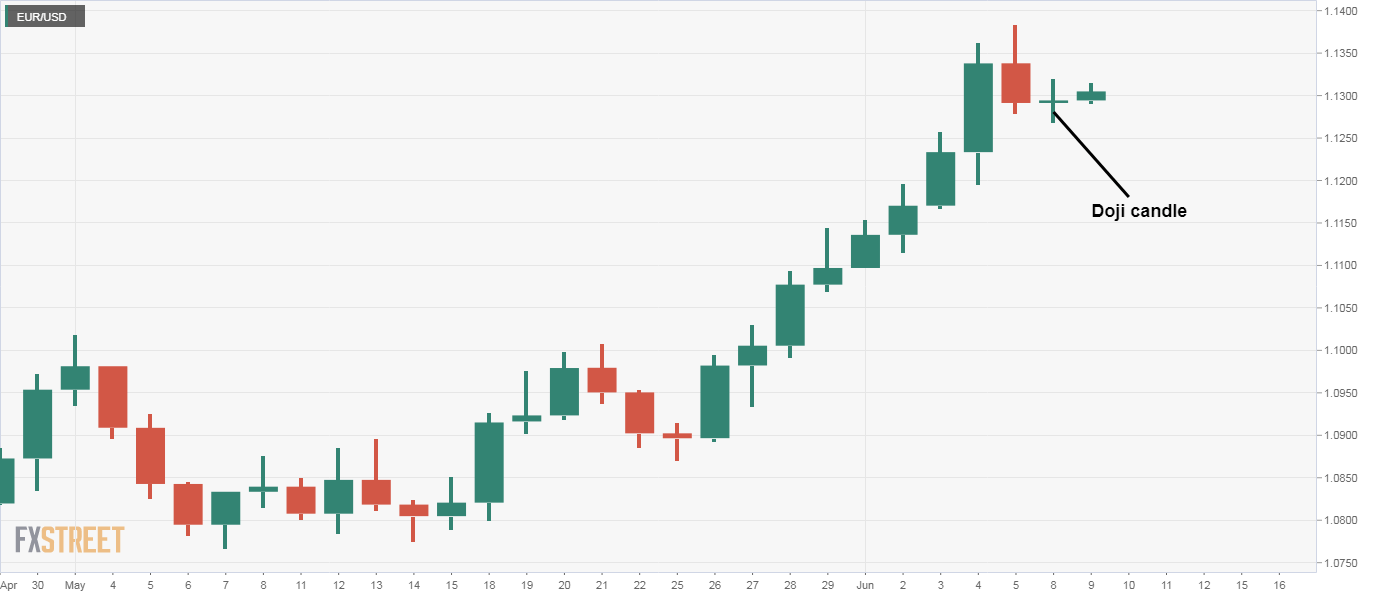

EUR/USD Price Analysis: Hovers near 1.13, market looks to have turned indecisive

- EUR/USD created a Doji candle on Monday, a sign of indecision.

- A move above Monday's high is needed to revive the bullish technical outlook.

EUR/USD is trading near 1.13 at press time, having witnessed two-way business and a flat close on Monday.

Essentially, the pair carved out a Doji candle yesterday, which is widely considered a sign of indecision in the market place.

A move above 1.1320 (Doji candle's high) would mean the period of indecision has ended with a bullish breakout. That will likely yield a rally to 1.14.

On the downside, the Doji candle's low of 1.1268 is key support, which, if breached, would validate the buyer exhaustion signaled by the long upper wick attached to Friday's red candle and open the doors to deeper decline to the 200-hour moving average, currently at 1.1186.

That said, dips, if any, could be short-lived, as the 14-week relative strength index is now reporting bullish conditions with an above-50 print.

Daily chart

Trend: Bullish above 1.1320

Technical levels