EUR/USD meets support in the 1.1900 region

- EUR/USD bounces off lows in the 1.19 zone on Friday.

- Lower US yields remove strength from the dollar.

- German Producer Prices rose 0.7% MoM, 1.9% YoY.

The single currency keeps the erratic performance well and sound so far this week and now prompts EUR/USD to bounce off earlier lows in the 1.1900 neighbourhood.

EUR/USD stays capped by 1.2000

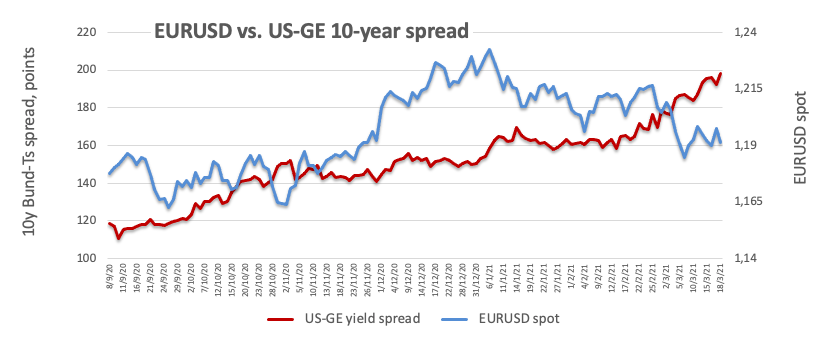

EUR/USD is up smalls above 1.19 the figure on the back of further correction in the greenback, which is in turn fuelled by the corrective downside in US yields. Indeed, yields of the key US 10-year reference edge lower from Thursday’s peaks around 1.75%, area last visited in January 2020.

In the meantime, market participants appear to have digested the FOMC event (Wednesday) and shift their focus to the progress of the vaccine rollout and prospects of economic recovery in the region.

Earlier in the euro docket, the German Producer Prices rose 0.7% from a month earlier in February and 1.9% over the last twelve months. Additionally, ECB’s Board members E. Fernandez-Bollo and F.Panetta are due to speak.

What to look for around EUR

EUR/USD keeps the consolidative theme unchanged, with support in the 1.1900 neighbourhood and the upper bound limited by the psychological 1.20 hurdle. The persistent solid stance in the greenback in recent weeks has put the previous constructive view in the euro under scrutiny, as market participants continue to adjust to higher US yields and the outperformance of the US economy (vs. its G10 peers) narrative. However, the steady hand from the ECB (despite some verbal concerns) in combination with the expected rebound of the economic activity in the region in the post-pandemic stage is likely to prevent a much deeper pullback in the pair.

Eminent issues on the back boiler: Potential ECB action to curb rising European yields. EUR appreciation could trigger ECB verbal intervention, especially amidst the future context of subdued inflation. Potential political effervescence around the EU Recovery Fund. Still huge long positioning in the speculative community.

EUR/USD levels to watch

At the moment, the index is up 0.03% at 1.1918 and a breakout of 1.1989 (weekly high Mar.11) would target 1.2064 (50-say SMA) en route to 1.2113 (monthly high Mar.3). On the other hand, the next support emerges at 1.1882 (weekly low Mar.16) seconded by 1.1843 (200-day SMA) and finally 1.1835 (2021 low Mar.9).