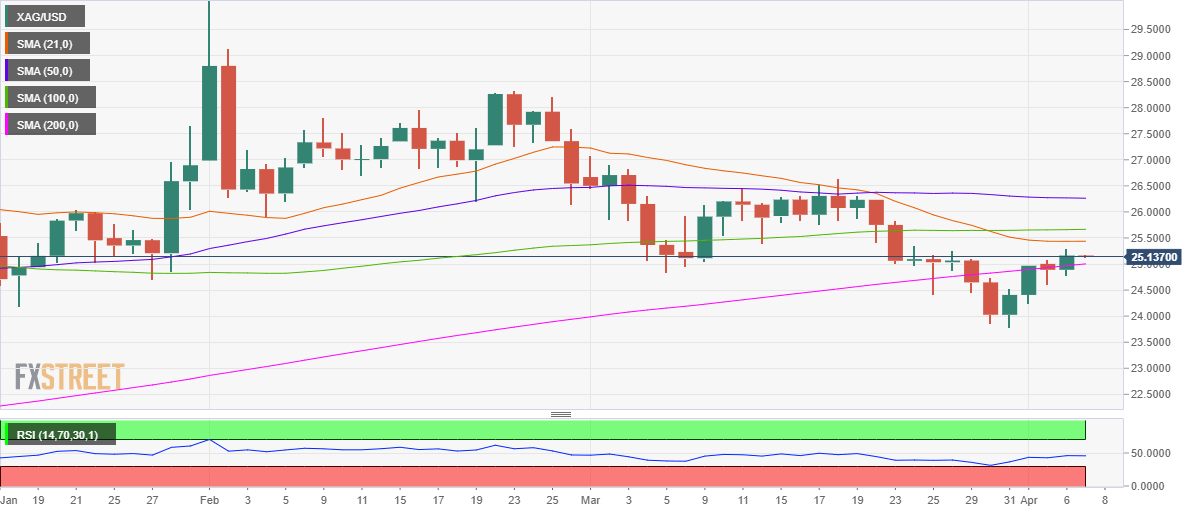

Silver Price Analysis: 21-DMA remains a tough nut to crack for the XAG/USD bulls

- Silver’s daily closing above 200-DMA on Tuesday keeps the buyers hopeful.

- Although the 21-DMA offers immediate resistance to XAG/USD.

- RSI stays bearish, suggesting limited upside attempts.

Silver (XAG/USD) is struggling to extend Tuesday’s rebound above the critical 200-daily moving average (DMA), now at $25.00.

Despite the spot gave a daily closing above that level, the bulls are facing an uphill task so far this Wednesday, as the 14-day Relative Strength Index (RSI) continues to trade within the bearish territory, indicative of shallow recovery attempts.

A sustained break below the 200-DMA resistance now support could trigger a fresh sell-off towards the April 5 low of $24.61.

The sellers could then target the three-month lows of $23.78 if the $24 threshold fails to defend the bullish sentiment.

Silver Price Chart: Daily

Alternatively, acceptance above the horizontal 21-DMA at $25.43 could expose the next barrier at 100-DMA, which stands at $25.66.

Further up, the XAG bulls would need to tackle the $26 psychological mark for a sustained move northwards.

Silver Additional levels