AUD/USD Price Analysis: Refreshes weekly top as bulls cheer 0.7110 breakout

- AUD/USD prints three-day rebound from yearly bottom, rises one-week high at the latest.

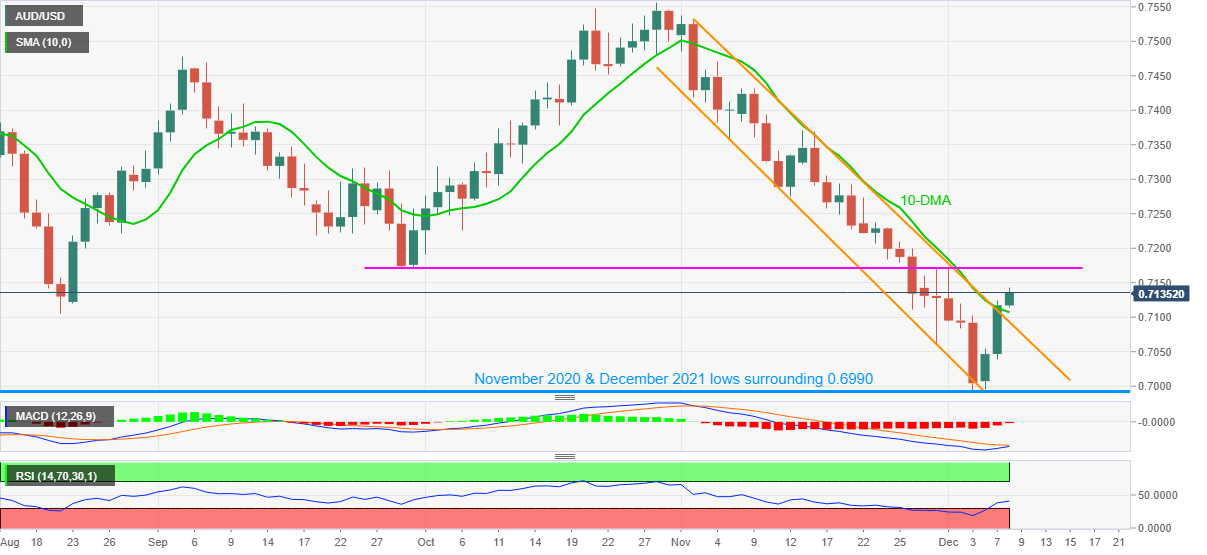

- Clear break of 10-DMA, descending trend channel favor buyers.

- RSI, MACD conditions add to the bullish bias targeting 10-week-old horizontal resistance.

- Lows marked during November 2020, December 2021 offer strong support.

AUD/USD takes the bids to refresh weekly high around 0.7145 during early Wednesday. In doing so, the Aussie pair justifies the upside break of the key 0.7110 resistance confluence, now support, amid firmer sentiment.

Given the receding bearish bias of the MACD and RSI’s rebound from the oversold area, the quote is likely to extend recovery from a horizontal area including lows marked during November 2020 and so far during December 2021, near 0.6990.

Hence, the AUD/USD bulls are set to battle the 0.7170 resistance that encompasses September lows and last week’s tops. However, the quote’s further upside will need validation from bottoms marked during late August and September, close to 0.7225-30.

Meanwhile, pullback moves will aim for the 0.7000 threshold but the rock-solid support near 0.6990 will challenge the AUD/USD bears afterward.

In a case where the pair drops past-0.6990, it becomes vulnerable to slump towards June 2020 swing lows of 0.6775. During the fall, the 0.6900 and the 0.6800 thresholds may act as buffers.

AUD/USD: Daily chart

Trend: Further upside expected